What is rich? In the world of the American taxpayer, you’re only as upper-income as you feel

Archive for January, 2003

Posted by taxguru on January 13, 2003

O�Neill questions Bush�s tax plan

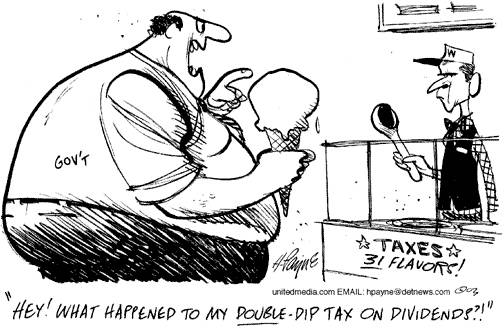

It’s obvious that Bush made a very smart move when he kicked this bozo off of his team. A Treasury Secretary who doesn’t understand the many widespread benefits of an elimination of the double taxation of corporate income was obviously in the wrong position. Hopefully he’s enjoying his new life as a full time U2 groupie.

KMK

Posted in Uncategorized | Comments Off on

Posted by taxguru on January 12, 2003

Tax Burden

With the left’s class warfare in full force, it’s a good time for a refresher on how out of skew the tax burden is in this country. The liberals, in their infamous strategy of incrementalism, have done an excellent job of shifting the bulk of the tax payments to a minority of people, who are easily ganged up on.

A few months ago, Rush Limbaugh added a pie chart and links to detailed statistics on this point on the bottom of his main web page. He swears that it will stay there for the next 300 years to make sure this imbalance is not forgotten. Another good explanation of this persecution of the evil rich, with some handy charts and stats, is this article by William P. Kucewicz

Jonah Goldberg makes a good analogy of shared sacrifice between the taxes in this country and the military.

To top things off, there is no better example of how vulnerable we can become by relying on a small number of people to carry the load than what is happening in the PRC.

Proving that one person’s blessing is another person’s curse is this story about the uneven tax burden in Washington state. Having no state income tax, a larger share of revenues are generated by sales taxes. Since poorer people allegedly pay a higher percentage of their income in sales tax, the argument is that the state’s reliance on that places a disproportionately high share of the overall tax responsibility on people in the lower income levels. This is obviously an attempt to start the ball rolling to establish a state income tax so that the super evil residents of that Left Coast state, such as Bill Gates, will be forced to shoulder a larger portion of the tax load.

KMK

Posted in Uncategorized | Comments Off on

Posted by taxguru on January 11, 2003

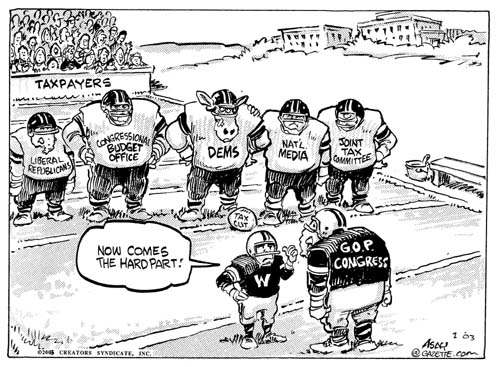

The hardest part about making the tax system fairer is weaning the big government vampires off of those dollars. Money for their insatiable thirst is far more important than any sense of fairness.

Posted in Uncategorized | Comments Off on

Posted by taxguru on January 10, 2003

State hikes may offset Bush plan

As the president urges tax cuts to spur economy, states from California to Kentucky slash budgets and raise taxes.

Posted in Uncategorized | Comments Off on

Posted by taxguru on January 10, 2003

Strangest state tax laws

Just wait until PRC Governor Gray-out Doofus comes up with his “solutions” to that state’s budget problems. Strange will be the understatement of the year for those concoctions.

Posted in Uncategorized | Comments Off on

Posted by taxguru on January 10, 2003

Don’t Hate Me Because I’m Rich

The liberals don’t just hate the super-wealthy, such as Bill Gates. As I’ve explained on several occasions, the definition of who exactly are the dreaded evil rich in this country differs for each tax rule. For example, single persons earning more than $25,000 per year and married couples earning over $32,000 per year are considered evil rich and are required to pay tax on 85% of their Social Security benefits in contrast to the original promise that all benefits would be completely tax free for everyone. Similarly, just as this article describes, a good many senior citizens receive dividend income.

Posted in Uncategorized | Comments Off on

Posted by taxguru on January 10, 2003

It will definitely be an uphill battle.

Posted in Uncategorized | Comments Off on

Posted by taxguru on January 10, 2003

Eliminating Taxes On Dividends

As was entirely expected, the lefties are playing the class envy card in their hysteria against the possibility of Bush proposing eliminating the double taxation on corporate dividends. “Tax cuts for the evil rich” is their mantra. Some recent examples of these anti-capitalism rants:

Assuming Bush can resist the desire to make his leftist critics like him, and dividend income becomes tax free to stockholders, it will change tax planning slightly. As I have explained for decades, using a C corporation allows you to reduce your taxes by tens of thousands of dollars each year. To avoid the double taxation, it has been my policy to never take out money from the corporation as dividends. We use expenses that are deductible by the corporation, such as wages, commissions, leases, interest and royalties. If dividends become tax free, these will be added to the equation and used when appropriate.

Shifting income to a C corp will still make a lot of sense. For example, if you are in the 35% bracket on your 1040, you can shift $50,000 to your C corp, where it is taxed at 15%. You will then be able to to have the corp pay you tax free dividends. That would save you $10,000 in Federal income tax alone ($50,000 X 20%). Since most business income would also be subject to the 15.3% Self Employment tax, by running $50,000 of profit through a C corp would save at least another $7,650 in that tax. The actual reduction in SE tax is normally much larger.

KMK

Posted in Uncategorized | Comments Off on

Posted by taxguru on January 10, 2003

Computer Problems

We’ve all experienced computer bugs, both in software and hardware. In fact, 100% bug-free computers are a figment of our imagination. However, this is the first time I have heard of a computer snake. From the URL, it looks like this was in Australia.

KMK

Posted in Uncategorized | Comments Off on