With a shutdown of the Federal government looking more and more likely, I’m sure a lot of people are wondering how this will affect IRS functions, especially since a lot of 2022 tax returns are due in by October 16.

The news media has not covered this particular angle to the budget battle, so I continued my limited experimentation with the infamous $20 per month ChatGPT and discovered that IRS prepares for this kind of event by having a formal “Lapse Appropriations Contingency Plan” to give them guidance.

A quick internet search turned up this 144 page plan for the fiscal year starting October 1, 2023 on the Treasury Dept website. The plan is very fresh, dated as of yesterday, 9/27/23.

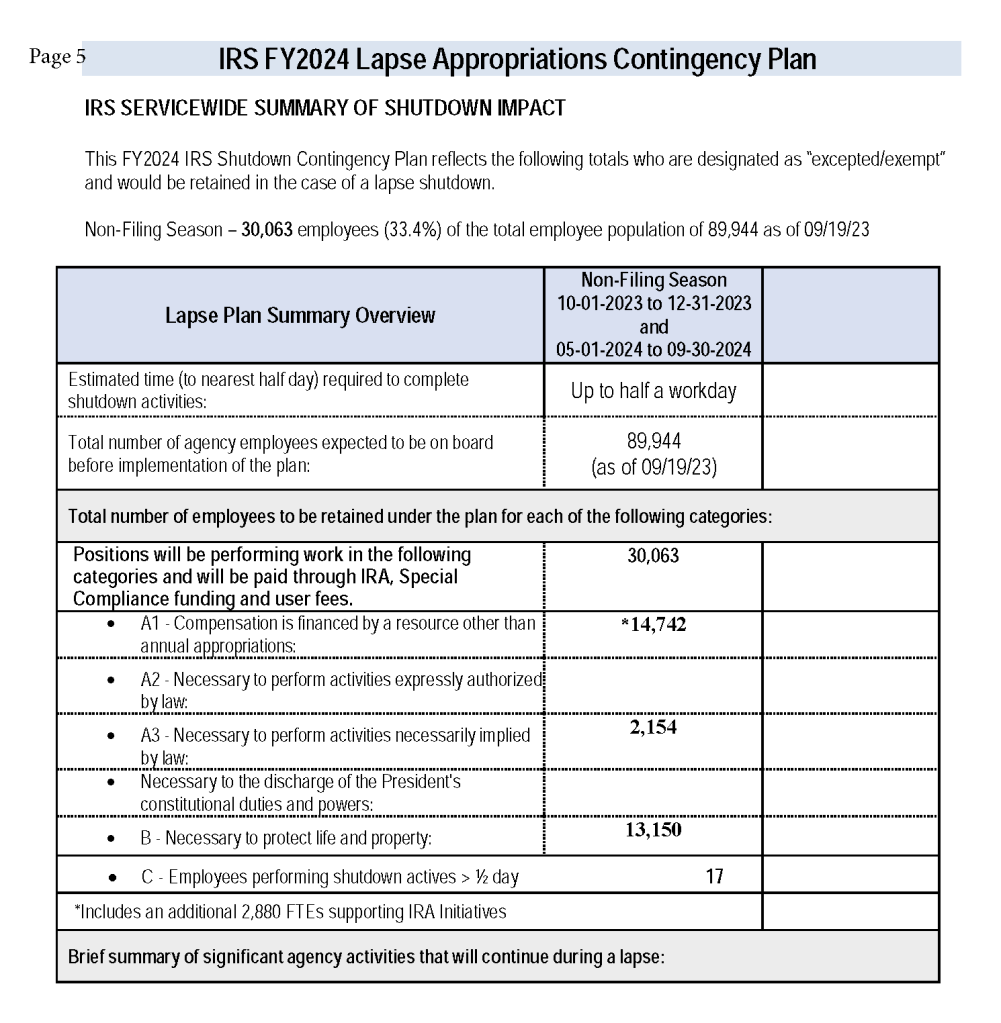

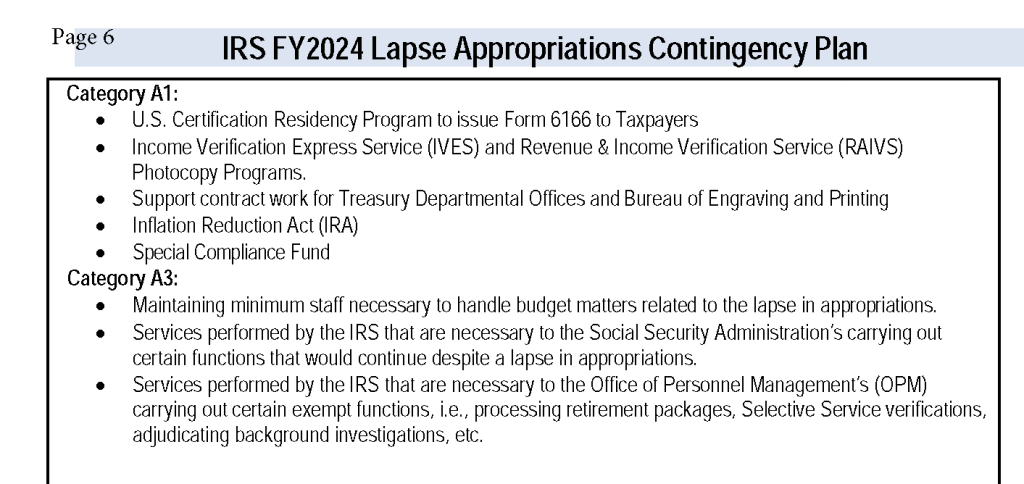

I have only skimmed it, but found the key info as to which employees will be furloughed (aka Paid Vacation) during the shutdown and which will continue to work on Pages 5, 6 and 7, which I am posting here.

Of immense interest to me, and I’m sure many other people, is the fact that all audit and examination functions will cease during a lapse (aka Shutdown).

You must be logged in to post a comment.