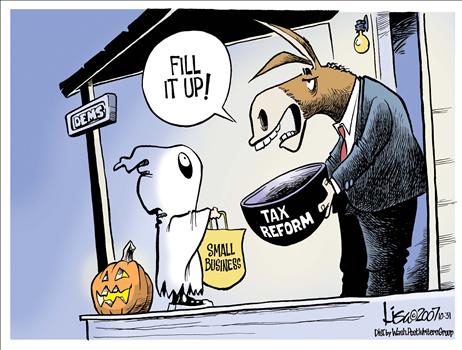

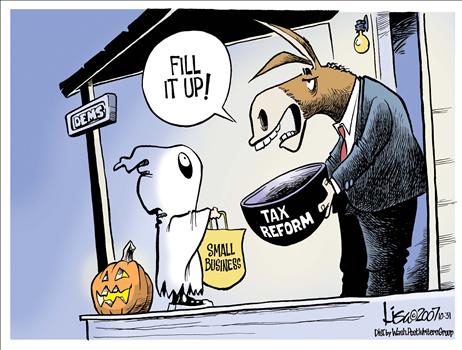

Posted by taxguru on October 31, 2007

Posted in comix, Commies, Hitlary, TaxHikes | Comments Off on As always, the Dims have plenty of tricks, but very few treats for us capitalists…

Posted by taxguru on October 30, 2007

Rush Limbaugh and Paul Shanklin had this clip of Charlie Rangel in yesterday’s show explaining his new tax plan, to eliminate the current Alternative Minimum Tax (AMT) and replace it with the No Alternative Maximum Tax (NAMT). He explains that this means “You make it and we take it. No alternatives.”

Posted in AMT, comix, Commies, TaxHikes | Comments Off on Rangel explains his NAMT

Posted by taxguru on October 27, 2007

Posted in comix, Commies, TaxHikes | Comments Off on DemonRats’ Targeted Tax Increases…

Posted by taxguru on August 25, 2007

Q:

Subject: Tax Question and Great Thanks!Let me first say Thank You for your taxguru.org site and your blog. I have been reading the material several times over to get it to sink. Of course, I am consulting my two knowledgeable colleagues and reading IRS doc/online resources to augment your articles.Currently I am an IT consultant but I want to be my own business and try to make my own fortune. The problem is, when I want to learn something new I attack it hard. This means I am in serious study mode right now. Okay , onto the question..:)QuestionI have a question regading the following verbiage taken from this link:“A C corporation has its own progressive tax rate structure, ranging from 15% on the first $50,000 of net income, to as much as 39%. My philosophy is to look at the overall tax picture for individuals and their companies by smoothing income over the personal (1040) and corporate (1120) tax returns. For 2000, a married couple’s 15% tax bracket ends at $43,850 of taxable income. It then jumps to 28%, almost double the rate. However, if you consider that the couple’s C corporation has its own $50,000 15% bracket, their overall combined 15% bracket has more than doubled to $93,850. That alone can save several thousands of dollars per year in income taxes.”What is some good study material to get some practical examples for dividing my income from my business (when I start it) and my personal income to keep me in the lowest possible tax bracket for both?In regards to the very first sentence, why would the tax rate be “flexible” and range from15% to 39%? Why isn’t a static figure? Where can I read more to understand this? Or did you mean that the maximumI actually have two more questions but on a different topic but I’ll save that for a future correspondence if there is one. I sincerely appreciate any information/advice you can offer.Thank you,

A:

One of the basic fundamental aspects of the income tax system in this country has long been the use of “progressive” tax rates, which penalize those who earn more money by taking a larger percentage of their income away from them. You can see the current tax rate schedules on my website:

If we had just one single flat tax rate, there wouldn’t be as much opportunity for tax savings by the income smoothing strategies I mentioned on my website. Unfortunately, the pervasive “hate the rich” mentality in this country will never allow such a change.

Studying issues like this and discussing them with colleagues can only take you so far in understanding how to best maneuver within the tax system. You need to be working with an experienced professional tax advisor who can help you apply these and other strategies to your particular circumstances. There is no one size fits all solution to proper tax planning. What may be a good plan for a colleague could very well end up costing you a lot of needless additional taxes because such things as family members (spouses and kids) and personal likes and dislikes can have huge impacts on any tax saving plans.

Good luck. I hope this helps.

Kerry Kerstetter

Posted in Commies | Comments Off on Progressive Tax Rates

Posted by taxguru on August 15, 2007

Posted in comix, Commies | Comments Off on The Left’s answer for everything…

Posted by taxguru on August 8, 2007

Posted in comix, Commies | Comments Off on Official DemonRat Keyboard?

Posted by taxguru on August 5, 2007

The demagogues on the Left never bother to allow simple facts to get in the way of their anti-capitalist agenda. Blaming the Bush tax cuts for the collapse of the bridge is just one more example of how they conveniently ignore the very real fact that the lower tax rates promoted by Bush have resulted in record high tax revenues for all levels of government.

Here are some sample cartoons by leftist morons who want to make the Bush tax cuts appear to be the reason for the recent bridge collapse, as if without those cuts the bridge would be completely intact today.

(Click on images for full size)

Posted in comix, Commies, TaxCuts | Comments Off on Tax Cuts caused bridge collapse?

Posted by taxguru on July 14, 2007

Dems grapple with ‘rich’ – A cornerstone of DemonRat tax policy has always been classic Marxism by sticking it to those folks that they declare to be the “evil rich.” This article is another illustration of how flexible that term is. As I’ve been describing for decades, there are literally dozens of penalties on the evil rich built into the tax system that each start at different levels of income, and more are obviously being planned. When the Clintons move back into the White House, we can at least be sure of seeing another new tax like their 1993 “millionaire surtax” that kicked in at taxable income of $250,000.

As destructive as such penalties on success are for the economy and capitalism in general, they will be great for those of us in the tax minimization profession as we help more clients use such techniques as income shifting and multiple entities to avoid these new attacks on their wealth.

Posted in Commies | Comments Off on Soaking the evil rich…