Every year – not just every four years.

Posted by taxguru on February 20, 2006

Every year – not just every four years.

Posted in Uncategorized | Comments Off on Olympics For The Rest Of Us

Posted by taxguru on February 20, 2006

From a CPA:

Subject: Death of A Partner

Dear Tax Guru…

The person asking the question needs to be made aware of the IRC Code 754 election that may apply in this situation.

My reply:

That’s a very good point.

I will got some info on that posted soon.

Thanks for writing.

Kerry Kerstetter

Additional Info:

Proving again why no one reference book can be all things for all people, I compared the info included in both The TaxBook and the Small Business QuickFinder and have to give the nod to QF for including a lot more info on Section 754 than the brief summary in The TaxBook, such as the following quotes from the new QF Online Service, where they have the same content as in the books:

Optional Adjustment to Basis of Partnership Property (Section 754 Election)

Section 754 Election Because of differences between basis and FMV of assets in a partnership, inequities can result when partnership interests are sold or transferred.

Under a Section 754 election, the purchaser’s basis in partnership property is adjusted to reflect the purchase price and the partnership interest. This reduces negative tax effects when basis in acquired partnership property is less than the amount paid for the partnership interest.

Gain upon liquidation of a partner’s interest may occur from a Section 754 election. The election is used to remedy the negative tax consequence when an amount paid for a partnership interest is greater than the partnership’s basis in its assets. Since the election can increase the partner’s ability to deduct depreciation on partnership property, the gain upon liquidation of the partner’s interest may also be increased.

Posted in Uncategorized | Comments Off on Adjusting Partnership Basis

Posted by taxguru on February 19, 2006

Posted in Uncategorized | Comments Off on It’s Mutual

Posted by taxguru on February 19, 2006

Q:

Dear Kerry:

Our corporation can purchase the 2006 Denali Pickup with the crew cab and short bed for $39,784. No trade-in or down payment is involved. The GVW is 7,000 lbs.

Please let me know as soon as possible if this vehicle would qualify for the full deduction or do we need something bigger?

A:

You’re not going to believe this one. I checked the specs for that Denali on the GMC website and they show the short bed as being 69.2 inches long. The rules for deducting more than $25,000 for a vehicle specify that it:

“is equipped with a cargo area of at least 6 feet in interior length which is an open area or is designed for use as an open area but is enclosed by a cap and is not readily accessible directly from the passenger compartment”

Since six feet is 72 inches, the short bed is 2.8 inches too short to qualify for more than a $25,000 Section 179 deduction.

While the Standard Box is specified as being 78.7 inches long and the Long Box as 92.6 inches, neither seems to be available with the crew cab.

I hope this helps you decide what vehicle to purchase. Remember that even if you can only claim $25,000 under Section 179, the remaining cost can be depreciated over the five year life of the vehicle.

Kerry

Posted in 179 | Comments Off on Length of Pickup Bed

Posted by taxguru on February 18, 2006

Bush Says Mortgage Interest Deduction Safe – This will hold off the much anticipated burst in the real estate bubble a little while longer.

Bridging the Gap Between Selling Your Home and Buying a New One

When Entrepreneurs Make a Decision to Hire

Posted in Uncategorized | Comments Off on

Posted by taxguru on February 18, 2006

Q:

Subject: 1040 Express Answers

Hello, I noticed you mentioned that you are using the CCH 1040 Express Answers book. I am considering this book. How does it compare to similar products, such as Quickfinder and The Tax Book?? I noticed in one of your posts that you couldn’t find the updates page for the Express Book. I came across it doing a Yahoo search. I’m sure I can find it again, if you haven’t found it by now. Any feedback greatly appreciated.

A:

Check out this post from last December.

Since I wrote that earlier piece, I have been using The TaxBook almost exclusively and have rarely had to open any of the QF books, which I did buy this year. I have been most impressed with the table of contents it has on each tab page. It’s made finding things much more efficient.

A few weeks ago, I finally received my copy of TMI’s All States Edition of the TaxBook. I was similarly impressed with how they set this book up and already consider it superior to the comparable book from QuickFinder.

If you are looking for just one book to work with, I heartily recommend The TaxBook.

Good luck.Kerry Kerstetter

Follow-Up:

Kerry, so I gather from your post, that you would recommend The Tax Book over the CCH 1040 Express Book? I am trying to find just one book to have as a reference. Thanks for your reply.

Posted in Uncategorized | Comments Off on Choosing A Reference Book

Posted by taxguru on February 18, 2006

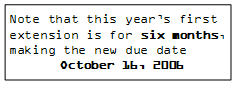

I just printed out my first 2005 extension form (Form 4868) for a client and was disappointed that nowhere does the version that Lacerte prints out say that this year’s first automatic extension is for six months. Knowing that this will create a lot of confusion, as well as a lot of anxiety around August 15, I used my Microsoft Publisher program to create a label that we will be sticking on each 4868 we prepare.

That’s still no guarantee that everyone will actually read the date, as I’ve noted with how many clients overlook the extended dates printed on the other extension forms.

Posted in Uncategorized | Comments Off on Form 4868 Due Date

Posted by taxguru on February 18, 2006

From a reader in Iraq with a USMC email address:

Subject: Your web site

find your references to the filthy rich disgusting.

Furthermore, if we had a decent tax scheme (VAT) we could do without most of you deadweights and lawyers and hope you found real work. Talk about a filthy line of work…..

My Reply:

You obviously haven’t read much of my stuff because your anger at the tax system is very misdirected by blaming me. I have long been a very outspoken and active member of the fight to repeal the 16th Amendment and eliminate the entire income tax system. I actually worked in the 1996 & 2000 Libertarian Party presidential candidate Harry Browne‘s campaigns, which included a plank in his platform to eliminate the income tax entirely. I was on some radio interviews with him expressing my 100% support for this objective.

I have been in this business for over 30 years and long ago recognized that it is well beyond any kind of repair, which is why I have also long been a supporter of the FairTax movement to replace the income tax with a national sales tax.

Far from being scared at losing a lucrative income stream, I would like nothing better than to be able to use my skills and knowledge for other tasks than helping people battle the IRS.

In regard to your problems with the filthy rich, I’m not sure what you mean. You may have the same misconceptions as I addressed in several posts over the years, such as this one.

Thanks for writing.Kerry Kerstetter

Follow-Up:

I may have jumped the gun and apologize. I was looking for 2005 tax schedules and your page came up on Google – all I saw were references to the filthy rich and no tax schedules….

I would love to see a flat user-based tax, and to see Congress go home part of the year with less taxes to spend, or tax laws to write. The abolishment of the IRS would be a great side benefit. I read long ago the tome, To Harass Our People by the Idaho representative who later was incarcerated for his cajones to take on the IRS…..

Mea Culpa and hang in there-

Posted in Uncategorized | Comments Off on Jumping to Conclusions

Posted by taxguru on February 17, 2006

Posted in Uncategorized | Comments Off on If death were like taxes:

Posted by taxguru on February 17, 2006

Posted in Uncategorized | Comments Off on Are people really looser with "plastic" money?