Archive for April, 2010

The Cruelest Month?

Posted by taxguru on April 5, 2010

Posted in comix, TaxSeason | Comments Off on The Cruelest Month?

Changing Corp Year

Posted by taxguru on April 5, 2010

Subject: Changing Fiscal Year

Dear Mr. Kerstetter,I was just reading your post about choosing a fiscal year and I’m left slightly confused. You said that if you have not yet filed a corporate return, then there is no need to “ask” the IRS for permission to change the fiscal year, but then you leave Form 1128 at the bottom of the page. If we’ve not yet filed an 1120 (as we are in the midst of our first fiscal year), and we originally, when applying for our EIN, put 12/31/09 as our year end, then is it necessary to tell them we’re going to switch it?

Thanks,

You seem to be under the impression that you have already officially selected a fiscal year when you filed the SS-4 to obtain your FEIN. That is not the case. Whatever you had on the S-4 is not officially binding.When you file your first 1120, that is what officially establishes the tax year for that corp. If no 1120 has been filed, the year can end at the end of any month.

You really should be working with an experienced tax pro on matters such as this to avoid making mistakes that you will regret later on.

I hope this helps. Good luck.

Kerry Kerstetter

Thank you very much for your response. I just wanted to confirm this information. I have spoken to several accountants and I am a new lawyer myself — but I was thrown off guard by a woman at the IRS this morning who told me I would have to file a form (1128?) in order to change the fiscal year. We will just file the 1120 within 75 days of March 31, and that will take care of it.

I noticed you mention the fact you will be presenting videos on your web site at some point soon. If you ever need any production services, that is exactly what our company does.

Thanks again for your help,

That is why asking for advice from the IRS is so dangerous. They are notorious for giving incorrect advice.Just to follow-up on the timing required, the 75 days isn’t a requirement. I have had dozens of cases with new corps, where we filed the original 1120 very late and that established the tax year.

We have even had cases where we filed extensions on Form 7004 based on the year-end that we thought would be used and then, for various reasons, changed our minds as to the proper year-end to use. The tax year shown on the 7004 isn’t any more binding than the one shown on the SS-4. When we filed the actual 1120, that was the first and only official notification to IRS of the corp’s tax year that mattered.

I am planning to start my video programs off on a small scale; but will keep your company in mind if it needs to be done more professionally on a larger scale.

Good luck.

Kerry Kerstetter

Posted in corp | Comments Off on Changing Corp Year

Posted by taxguru on April 5, 2010

20 Best Blogs for Tax Advice – Some new names on this list, as the number of people sharing their tax expertise on the web grows.

Posted in blogs | Comments Off on

IRS Job Potential

Posted by taxguru on April 3, 2010

Posted in IRS | Comments Off on IRS Job Potential

Posted by taxguru on April 2, 2010

Late Nite Jokes via NewsMax:

Jay Leno:

Today is April 1, April Fools’ Day, a day that people try to fool their friends and relatives. Don’t confuse that with April 15, when people try to fool the IRS.

Jimmy Kimmel:

When it comes to taxes, there are two types of people. There are those that get it done early, also known as psychopaths, and then the rest of us.

Posted in humor | Comments Off on

TaxMan by Blue Floyd

Posted by taxguru on April 1, 2010

For those who haven’t heard of the musical group, Blue Floyd, they cover Pink Floyd songs in a blues style. I’ve downloaded and listened to several of their concerts over the past few years.

I was browsing the new concert torrents and found this one from 1/17/2002 of Blue Floyd playing 16 different Beatles songs, including the one many of us tax pros have obsessed over for decades, George Harrison’s TaxMan.

The entire concert is in the FLAC format and is a 675 mb download.

I used my Nero software to make an MP3 conversion of the TaxMan song that is only 5 mb and sounds exactly like the 52 mb FLAC version; at least on my computer speakers.

[Update] – There are some very interesting facts about this iconic song on Wikipedia that I hadn’t heard before.

Posted in Music, TaxMan | Comments Off on TaxMan by Blue Floyd

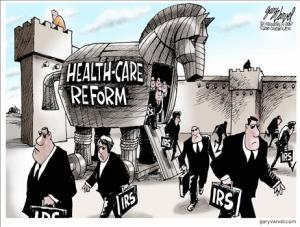

Unintended consequences?

Posted by taxguru on April 1, 2010

Debate brews over IRS expansion – As ordered by Queen Nancy Pelosi in her bizarro backwards world of Washington, DC, it’s now time to actually look at and debate what’s in the bill that she and her DemonRat disciples voted for a few weeks ago.

Posted in comix, IRS | Comments Off on Unintended consequences?